All Categories

Featured

Table of Contents

Another sort of benefit credit ratings your account balance occasionally (every year, as an example) by establishing a "high-water mark." A high-water mark is the highest worth that a mutual fund or account has actually reached. After that the insurance firm pays a death benefit that's the better of the bank account worth or the last high-water mark.

Some annuities take your initial financial investment and instantly include a certain portion to that quantity each year (3 percent, as an example) as a quantity that would be paid as a survivor benefit. Tax-efficient annuities. Beneficiaries after that receive either the real account value or the initial financial investment with the annual rise, whichever is greater

For example, you might select an annuity that pays out for 10 years, however if you pass away before the 10 years is up, the staying payments are ensured to the recipient. An annuity survivor benefit can be helpful in some scenarios. Below are a few instances: By assisting to prevent the probate process, your beneficiaries may receive funds promptly and easily, and the transfer is personal.

How can an Fixed Annuities protect my retirement?

You can usually choose from numerous alternatives, and it deserves exploring all of the options. Choose an annuity that functions in the way that finest aids you and your family.

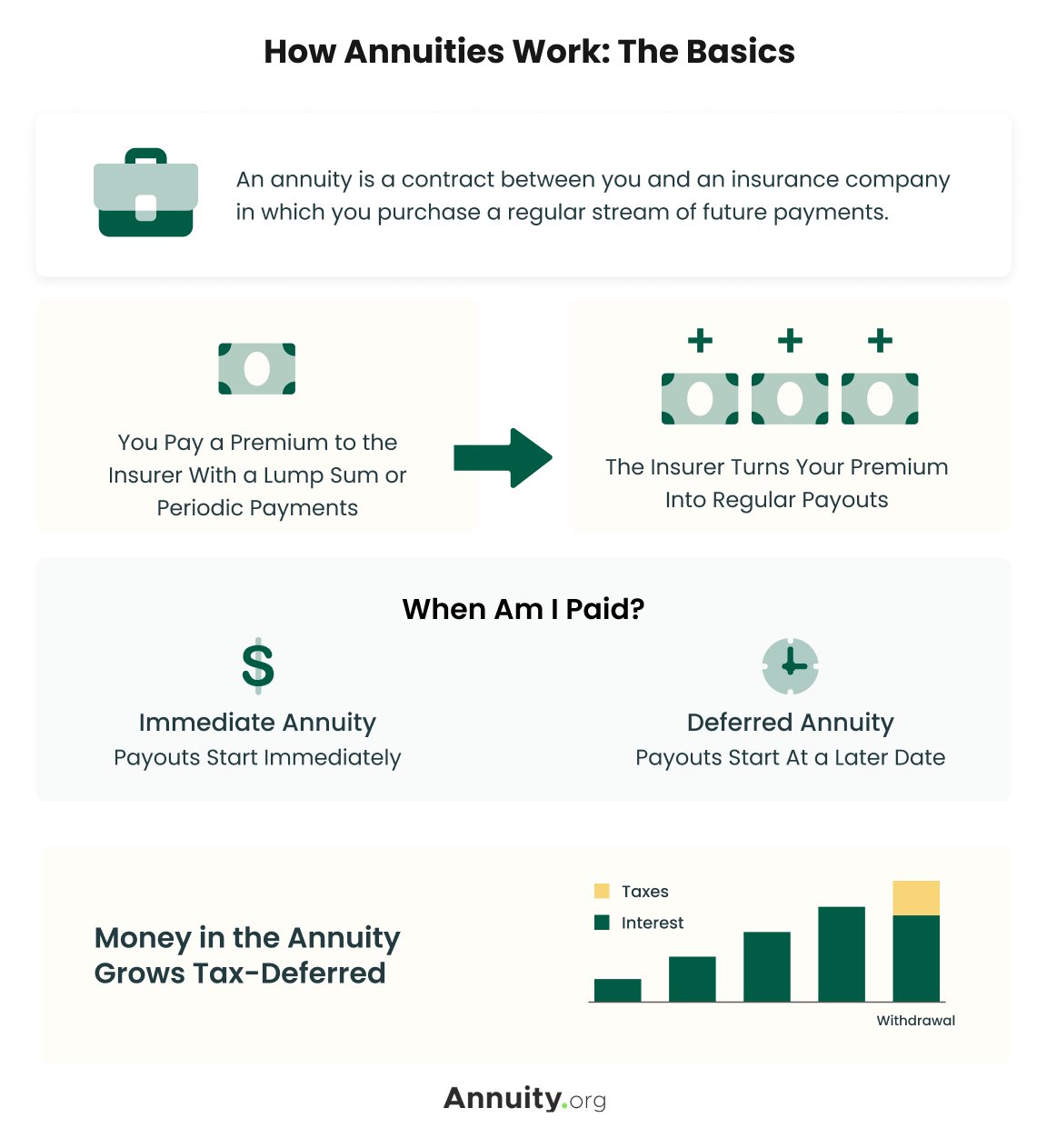

An annuity helps you collect money for future revenue demands. The most ideal usage for income payments from an annuity contract is to fund your retirement.

This product is for educational or academic purposes just and is not fiduciary investment guidance, or a safeties, financial investment strategy, or insurance coverage product recommendation. This material does rule out a person's very own goals or conditions which must be the basis of any kind of investment choice (Guaranteed income annuities). Financial investment items may be subject to market and various other threat variables

How long does an Annuity Contracts payout last?

Retired life repayments refers to the annuity earnings obtained in retirement. TIAA may share revenues with TIAA Traditional Annuity owners with stated added quantities of passion during accumulation, greater first annuity income, and with additional increases in annuity revenue advantages throughout retired life.

TIAA may provide a Loyalty Bonus offer that is only available when electing lifetime earnings. Annuity contracts may contain terms for maintaining them in force. TIAA Traditional is a set annuity product released through these agreements by Educators Insurance and Annuity Organization of America (TIAA), 730 Third Avenue, New York, NY, 10017: Type collection consisting of however not restricted to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8.

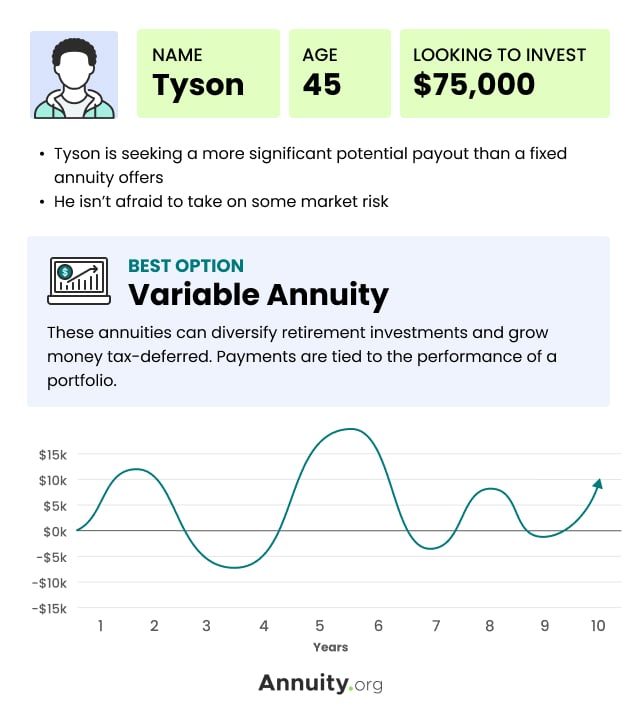

Transforming some or all of your savings to revenue benefits (described as "annuitization") is an irreversible choice. When earnings advantage repayments have actually started, you are not able to alter to an additional option. A variable annuity is an insurance coverage contract and includes underlying financial investments whose value is tied to market efficiency.

Retirement Annuities

When you retire, you can choose to get revenue forever and/or various other earnings options. The genuine estate sector goes through various threats consisting of fluctuations in underlying home values, costs and revenue, and possible ecological liabilities. Generally, the worth of the TIAA Property Account will vary based on the underlying value of the direct real estate, real estate-related investments, actual estate-related securities and fluid, set income financial investments in which it invests.

For a much more full conversation of these and other risks, please get in touch with the syllabus. Responsible investing includes Environmental Social Governance (ESG) factors that may affect exposure to companies, sectors, sectors, restricting the kind and number of investment opportunities available, which can result in leaving out investments that do well. There is no guarantee that a diversified profile will certainly boost general returns or outmatch a non-diversified profile.

Aggregate Bond Index was -0.20 and -0.36, respectively. Over this very same period, relationship in between the FTSE Nareit All Equity REIT Index and the S&P 500 Index was 0.77. You can not spend straight in any type of index. Index returns do not show a deduction for charges and expenses. Other payout alternatives are readily available.

There are no charges or fees to start or quit this feature. Nevertheless, it is essential to keep in mind that your annuity's balance will be minimized by the income repayments you receive, independent of the annuity's efficiency. Earnings Test Drive revenue settlements are based upon the annuitization of the amount in the account, duration (minimum of ten years), and other elements picked by the participant.

What is the difference between an Senior Annuities and other retirement accounts?

Any assurances under annuities issued by TIAA are subject to TIAA's claims-paying capacity. Transforming some or all of your financial savings to income advantages (referred to as "annuitization") is a long-term decision.

You will have the option to name numerous beneficiaries and a contingent recipient (a person marked to obtain the cash if the main beneficiary passes away prior to you). If you do not call a beneficiary, the accumulated properties might be surrendered to an economic institution upon your death. It's essential to be conscious of any type of monetary repercussions your beneficiary might face by acquiring your annuity.

Your partner might have the alternative to alter the annuity contract to their name and come to be the new annuitant (understood as a spousal extension). Non-spouse beneficiaries can't continue the annuity; they can only access the marked funds.

Are Annuity Riders a safe investment?

Upon fatality of the annuitant, annuity funds pass to an effectively called recipient without the hold-ups and costs of probate. Annuities can pay death advantages several various ways, depending on regards to the agreement and when the fatality of the annuitant happens. The option selected influences exactly how taxes schedule.

Choosing an annuity recipient can be as complicated as choosing an annuity in the initial location. When you talk to a Bankers Life insurance policy representative, Financial Rep, or Investment Expert Rep that offers a fiduciary criterion of treatment, you can rest guaranteed that your choices will assist you develop a plan that provides safety and security and peace of mind.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Variable Vs Fixed Annuities Matte

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Breaking Down the Basics of Annuities Fixed Vs Variable Benefits of Fixed Interest Annuity

Highlighting Pros And Cons Of Fixed Annuity And Variable Annuity Everything You Need to Know About Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Investment Plans Features of What

More

Latest Posts